A few days ago, I received an email from a competitor making the case for implementing a financial reporting system. It starts:

"Studies have shown that finance organizations typically spend almost half of their time just creating and updating reports. Rather than providing strategic insights to the organization, the FP&A team is wasting valuable time on menial work."

OK.

But, hhenever a sentence starts with “Studies have shown”, it probably should say “I’m sure there is a study somewhere that will back me up!”

And “typically spend almost half their time..” means “we don’t really know, but they do spend a lot of time..”

Nevertheless, I think we can agree that in today’s finance departments there is a lot of menial work that goes into the preparation of financial reports, most of it tied to spreadsheets. At least it is impossible to introduce errors into a spreadsheet report. Oh wait - I got that wrong. It is impossible NOT to introduce errors into a spreadsheet report. That is, if you can find the right version of the spreadsheet to mess up. I’m sure there are studies somewhere to back me up.

The email goes on:

"This time would be better spent equipping and empowering all business functions with the information they need to make better decisions. By automating standard reports and giving everyone the tools to generate reports autonomously, Finance gains more freedom to enable both short-term strategic decisions and long-term success."

100%! So let’s talk about ROI and what is possible by implementing an automated financial reporting system.

ROI

We’ll leave aside the issue of what software to use to build this magical automated financial reporting system, and consider the costs and benefits in a general sense.

(There is an excellent article on the Issuetrak website that explains the concept of ROI. They even provide a calculator that lets you plug in your own assumptions about a particular project. It is a downloadable Excel spreadsheet. I’m sure there is no chance of error in using it!)

(There is an excellent article on the Issuetrak website that explains the concept of ROI. They even provide a calculator that lets you plug in your own assumptions about a particular project. It is a downloadable Excel spreadsheet. I’m sure there is no chance of error in using it!)

Why are you doing this in the first place? What do you hope to accomplish? What is the payoff?

Here are the key benefits of implementing an automated financial reporting system:

- Time savings in report and budget preparation

- Improved accuracy

- Better decision making

The first one is the most quantifiable, while the last two are the real payoff.

Time Savings

You might be able to estimate the time savings for the finance staff, and multiply that by an hourly cost. OK - you probably won’t reduce staff and realize a direct cost savings in the short term. But you will be better able to handle growth without needing additional staff. Also, the time freed up can be spent thinking and analyzing, or doing other things of value.

I don’t have a study to back me up, but I do have some anecdotal evidence. Over the past few years I implemented a nifty financial analysis and reporting system for Issuetrak while serving as CFO. (I’ll describe the system in detail in a future blog post).

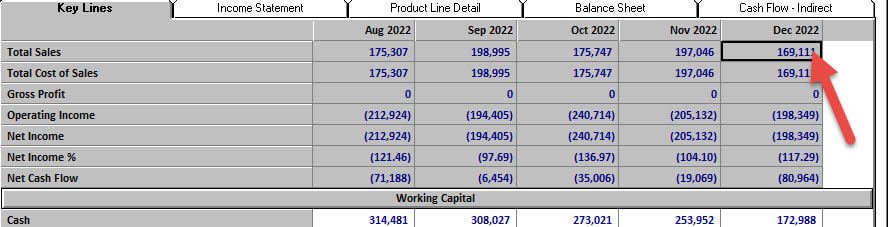

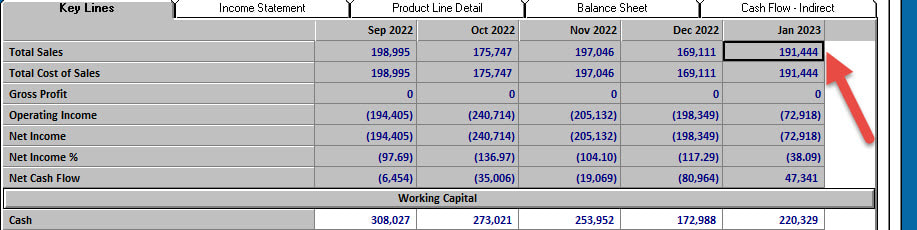

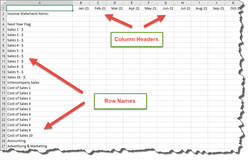

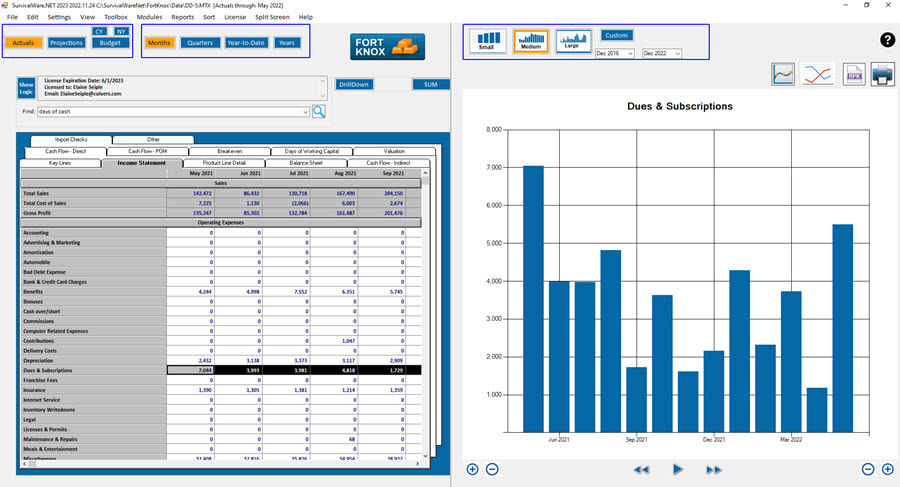

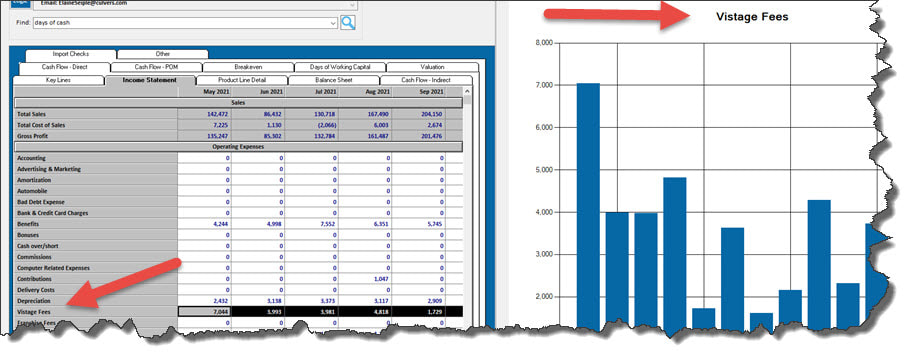

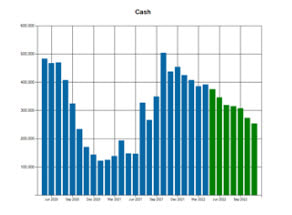

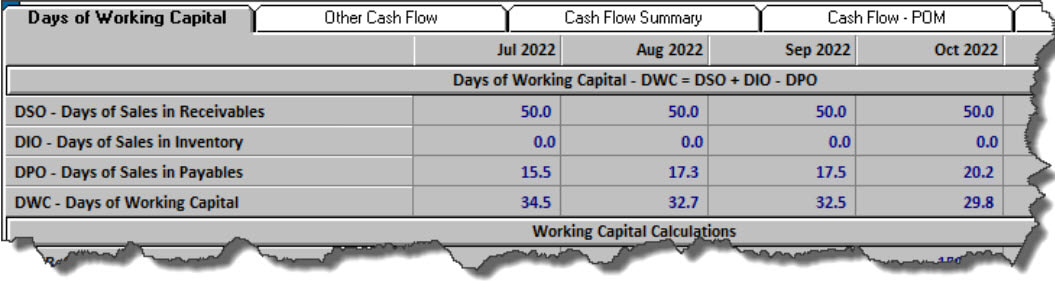

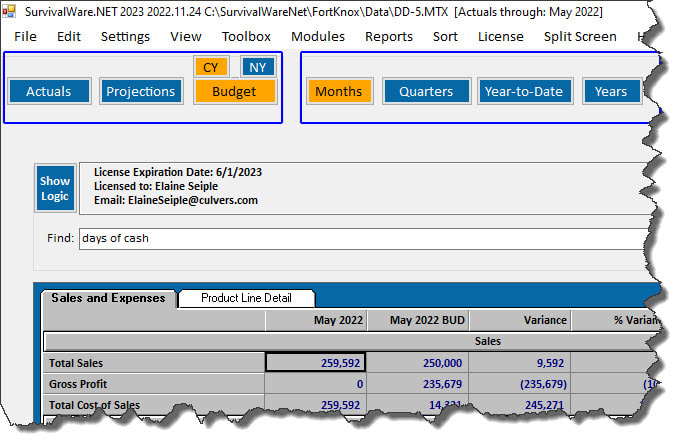

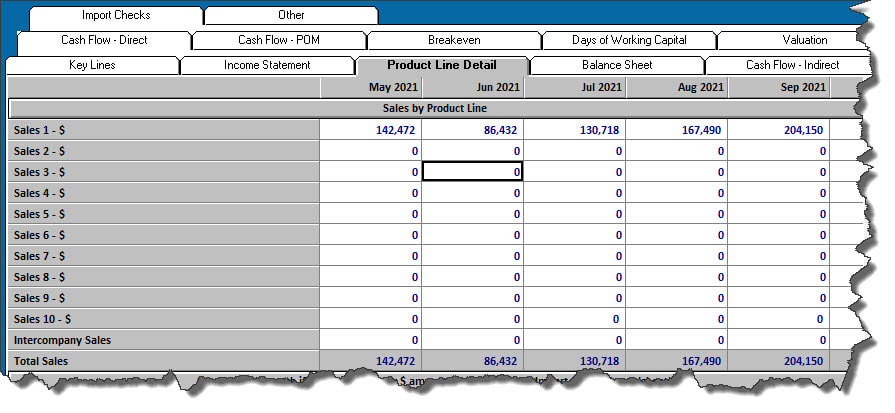

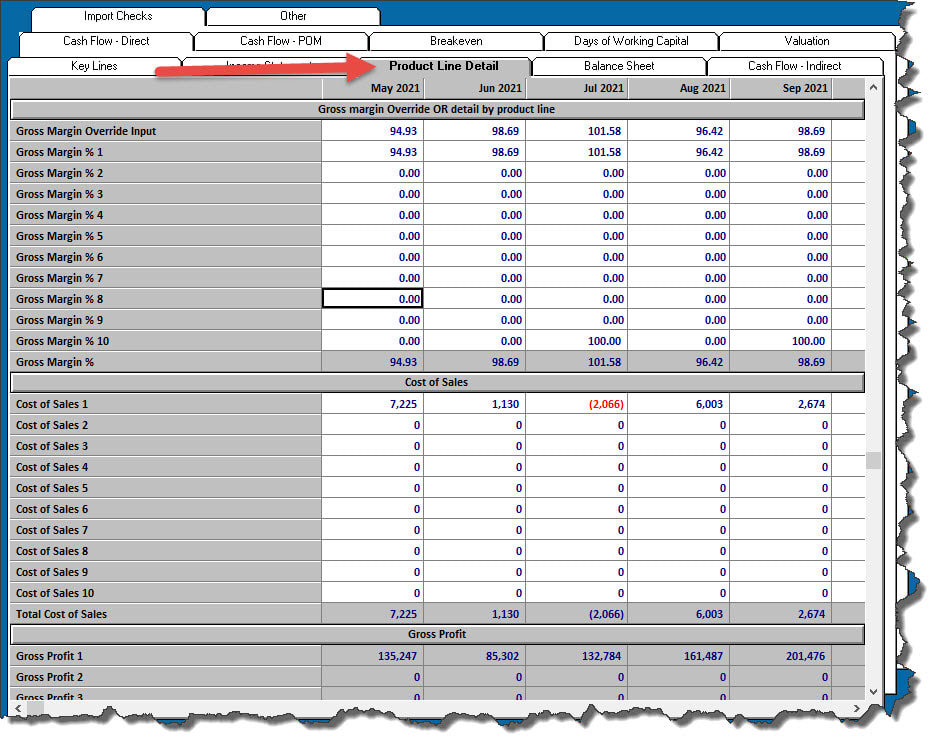

It pulls in financial data from Issuetrak’s accounting system. It also uses customer and sales funnel data from the CRM, salaries from the payroll system, and marketing metrics from various sources. At its core is a financial model that looks into the future, and helps keep us on track. The system is a wealth of information, and serves as the backbone for presentations at Board meetings, the monthly confidence package, KPI reports, and special analyses.

As a result of the high degree of automation, I have been able to cut back to part time. Issuetrak saves some big bucks. I get to live the dream. Not a bad outcome!

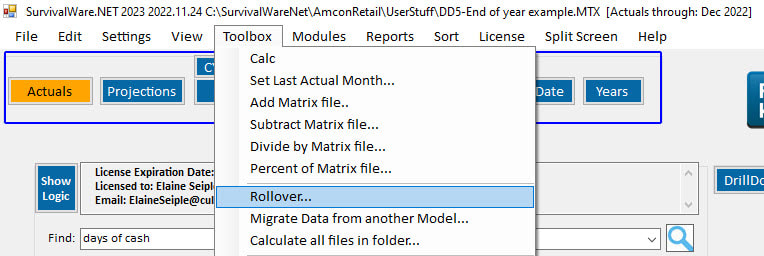

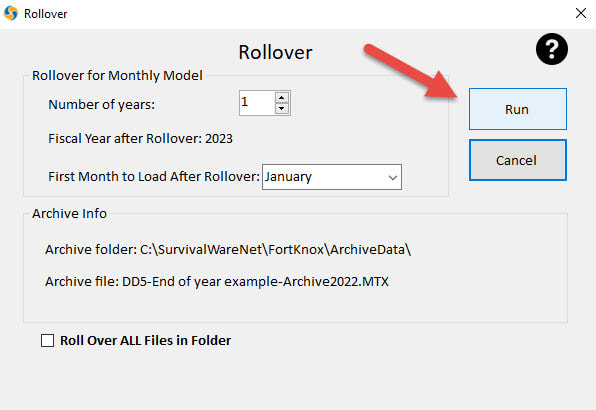

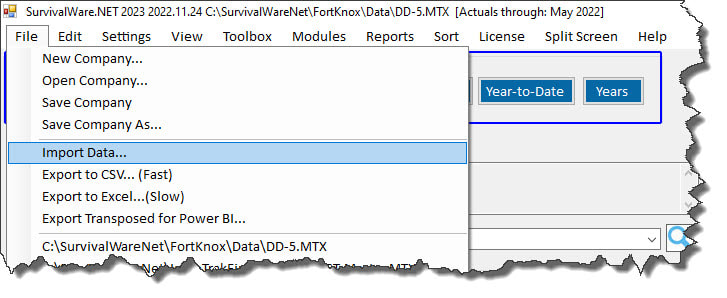

Then there is my friend, author and consultant, Philip Campbell. Philip has used SurvivaWare to automate the financial reporting systems of many companies (from the very small to the very large). He actually prepares a monthly confidence package or set of operating reports directly from SurvivalWare every month. The automated financial reporting frees him up to spend time at what he is good at - analyzing what is going on with cash and profits, and communicating his insights to decision makers. And playing golf?

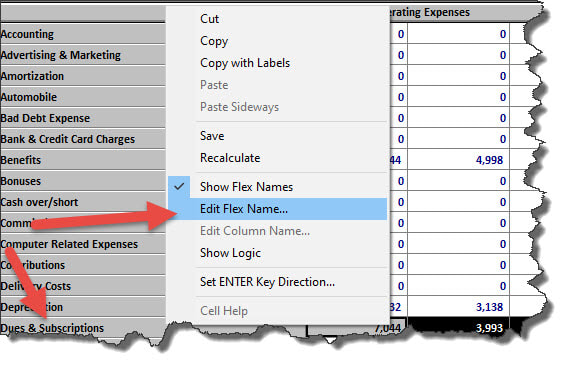

Philip says SurvivalWare is a must for any company he is working with because it automates the financial analysis, forecasting, and reporting process for him. It helps keep the data organized and all in one place. It allows him to quickly and easily stay on top of financial performance and cash flow. Spreadsheet version control is a thing of the past.

Philip does a great job of explaining financial forecast and cash flow in this real world example:

https://financialrhythm.com/understanding-cash-flow-real-world-example/

Improved Accuracy

Improved accuracy really is a thing. I’d hate to have to quantify its value - but it is there. Think FTX if you are looking for an example of bad things happening with bad financial data.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here [FTX]”

- John Ray, III - new CEO of FTX

You don’t want to be like FTX.

Accuracy is like your health - one of those things you notice only when it is gone. Automated financial reporting systems are not perfect. But compared to spreadsheets? Let’s just say the bar is low.

The other thing about an automated financial analysis and reporting system is that it improves your sense of smell. Of course, I mean your ability to apply the “smell test” to all sorts of data used to make decisions. Seeing monthly numbers side by side, especially in graphs, puts the spotlight on anomalies and candidates for more inquiry. Why did hosting costs double from one month to the next? Was that an accounting error, maybe timing?

You can compare sales totals from the CRM with the accounting system. They had better match, or someone has some splainin’ to do.

Decision Making

Is the Customer Acquisition Cost significantly higher than the lifetime value of the customer? Maybe it’s time to rethink our marketing strategy.

Other way around? Time to put the pedal to the metal!

If we reduce our collection period by 15 days, that frees up $500,000 of cash. Is it worth the effort?

What is the cash impact of ramping up the marketing budget if there is a 6 month lag in results?

Suppose sales dip 10% next year? Are we in trouble?

How sensitive is our business to interest rates?

The list goes on..

Back to ROI

We need to calculate the investment and compare it to the return.

The investment includes costs such as:

- Software licensing and maintenance

- Hosting fees

- Implementation

- Training

- Ongoing maintenance

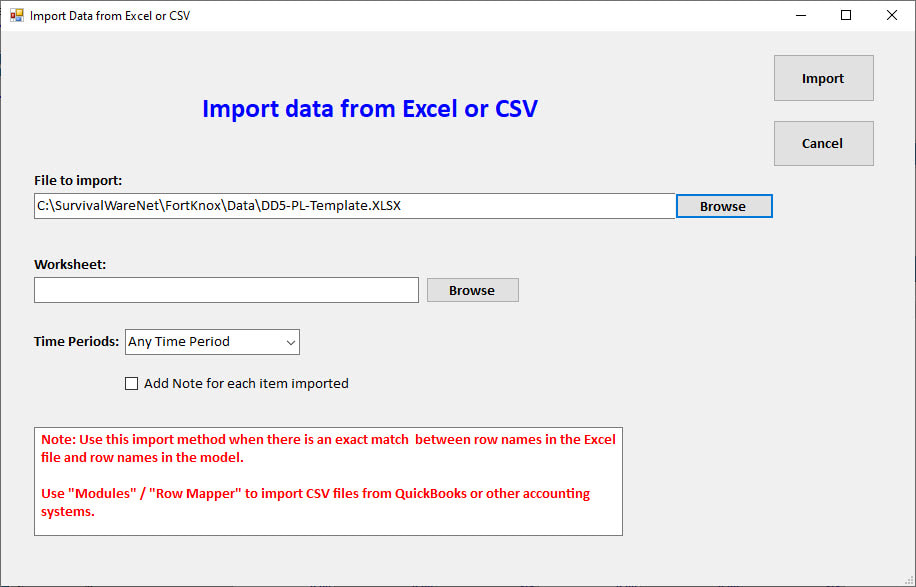

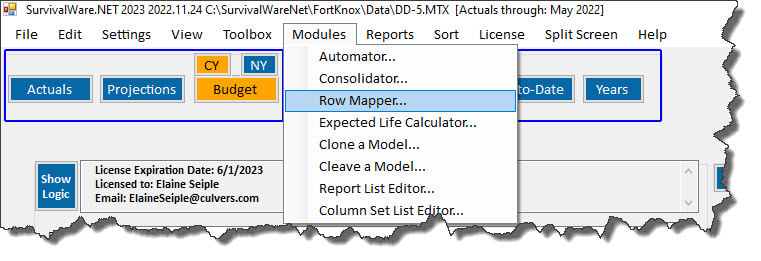

- Response to external changes (e.g. a feeder system has a change in format)

- New reports and analyses

- Support and problem resolution

You should be able to estimate these costs fairly easily. If you have engaged a software vendor or consultant, they will be able to get these numbers for you.

I’d suggest a 3 to 5 year time horizon, and penciling in costs for each year. The total investment for ROI purposes is the Net Present Value of these costs.

Return

Do the same for the return: pencil in the value of the time savings each year, and compute the Net Present Value.

To calculate the return:

- Estimate the time savings as a percentage productivity gain for key financial workers. Depending on how labor intensive your current process, you might come up with a number between 10% and 50%.

- Multiple this percentage by the fully loaded salaries of the workers involved. This gives you a number that should represent the minimum return you can expect to get.

For the soft benefits:

- Think hard about the types of errors you hope to eliminate. Have there been any whoppers in the recent past? List them out. Use words, not numbers. I know - you probably don’t want to call attention to any past mistakes. Think about them, anyway. Write them down. Use invisible ink if you must.

- Think hard about the types of decisions made based on the financials - both recent performance and near term outlook. Is survival an issue? Cash tight? Are there major decisions to be made about hiring and expansion? Remote vs hybrid office model? Major technology upgrades? An acquisition? The list goes on..

ROI is then:

(NPV Benefits minus NPV Costs) as a percentage of NPV Costs.

**NPV is Net Present Value.

Any software vendor worth its salt will be able to provide you with a spreadsheet showing huge benefits, modest costs, and a triple digit ROI. No possibility of errors in that spreadsheet!

But this is something you need to think about yourself, in the context of your business.

If you are trying to raise capital or sell the business, the value of good financial information - and hence, the value of an automated financial reporting system - skyrockets.

Chances are, there is a huge payoff from automating your financial reporting system. Just find a software vendor you can trust.

Oh wait - is that an oxymoron?!

RSS Feed

RSS Feed